Why Traders Don’t Make It

There’s this statistic that flows around the trading industry.

“95% of traders fail”.

If that’s the case, why even trade? Why would we do this to ourselves? Do we really believe we’re in the top 5%?

This is known as…

Optimism Bias

Believing that one is less likely to experience a negative event compared to others.

We have a tendency to believe we can be special. We’re more committed, more intelligent, and we have more tenacity.

It’s a well-documented trick the brain plays on us. Entire scientific papers have been written on the subject.

When your brain plays this trick, you cut corners. You may feel like a series of YouTube videos are enough to become profitable.

Interestingly enough, we don’t tend to suffer from this bias in other skills.

We all believe becoming an engineer is difficult. It requires a lot of study and practice.

The same with becoming a doctor, a pilot, or an accountant. You don’t believe you can do any of these jobs without proper structured training.

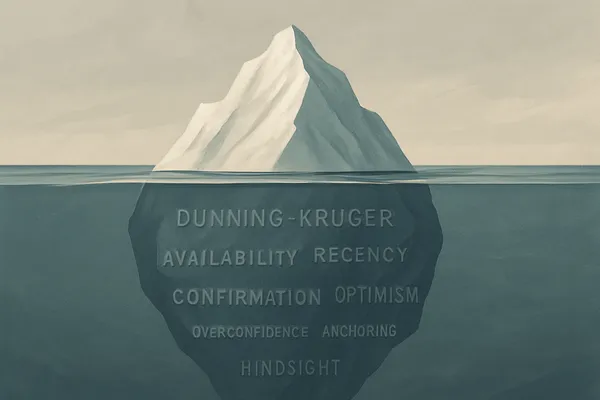

To make it worse, optimism bias is simply one of the tricks the brain plays on us when it comes to trading.

You won’t believe what else you have to battle to win at this trading thing.

The Biases You’re Up Against

Dunning-Kruger Effect: Overestimating one’s own trading skills due to a lack of knowledge and experience.

Overconfidence Bias: Having excessive confidence in one’s own trading decisions or strategies.

Confirmation Bias: Seeking or interpreting market information in a way that confirms pre-existing beliefs.

Anchoring Bias: Relying too heavily on the first piece of information seen (like initial price) when making decisions.

Availability Heuristic: Overestimating the importance of information that is readily available or memorable. Like seeing social media posts of profitable trades and believing this is the norm.

Hindsight Bias: Believing after an event has occurred that one could have predicted the event. “Ah, I should have seen that coming”.

Loss Aversion: Being more sensitive to losses than to gains of the same size.

Representativeness Heuristic: Judging the probability of an event by how much it resembles other events or trends.

Gambler’s Fallacy: Believing that past events can affect the likelihood of something happening in the future, despite no causal relationship.

Status Quo Bias: Preferring to keep things as they are, avoiding change.

Endowment Effect: Valuing a trade more highly simply because you took it.

Optimism Bias: Believing that one is less likely to experience a negative event compared to others.

Recency Bias: Overemphasizing the most recent information or experiences.

Framing Effect: Making decisions based on how information is presented rather than just on the facts themselves.

Self-Serving Bias: Attributing successes to personal skill and failures to external factors.

Bandwagon Effect: Adopting beliefs or practices because they are becoming popular or widespread.

Illusion of Control: Overestimating one’s ability to control or influence events, such as market movements.

Neglect of Probability: Ignoring the actual probability of outcomes, leading to poor risk assessment.

Sunk Cost Fallacy: Continuing a behavior or endeavor as a result of previously invested resources (time, money, effort).

The Battle You Didn’t Know You Signed Up For

While you believe that you “just need a profitable strategy”, you’re actually in an epic battle against the very DNA that built these biases’ into your brain.

Marketers play on these biases. For example, take #13, the Recency Bias.

If we show you a profitable trade that happened today, your brain will instantly assume it’s more important than a losing trade we showed you last week.

“You could have made this money today had you only known about this trading method”

Let’s try it.

Real Example: Simon Pullen

Below is a screenshot of a conversation we had with Simon Pullen.

He made £11,166.49 in a single month.

That information somehow feels important. It’s relatively recent.

Now compare it to the message below. Simon sent this on Monday, May 15th, 2023.

Want a breakdown of the trades he took last year or the ones he took this week? Or better yet, the ones he’s taking today?

That’s Recency Bias at work.

How do you overcome this?

At first, it may seem impossible to fight a losing battle against the very fabric of what makes us human.

But it isn’t.

The solution is very simple.

First, acknowledge that you aren’t special. You don’t have to be special to make money from the markets. Stop putting that kind of pressure on yourself, and it's unproductive.

Realize that you are fallible. You are prone to biases. It’s impossible to overcome something if you don’t acknowledge its existence. Forgive yourself for not being perfect. It’s OK.

Second, now that you know you aren’t special, stop trying to take shortcuts. Figure out the entire process and start at the beginning.

The following outline will help. We sent it in an email just a few days ago.

Step #1: Learn the components of the strategy.

Break the strategy up into component parts. Then, learn each component separately. If you are spotting supply & demand areas, then do this 20-50 times.

It works like this:

Learn component part.

Practice component.

Identify barriers (questions).

Get feedback from an expert.

Do this over and over again until you know the entire strategy. We would recommend doing this with multiple strategies. It gives you a very holistic understanding of all the components that could possibly make you money.

This step takes a while. Don’t rush it.

Step #2: Backtest the strategy.

Now that you know the strategy’s components inside out, you need to practice it as a whole. Backtesting view Bar Replay using TradingView is a great way to do it.

This is where you get the data you need to craft a strategy that fits your lifestyle, schedule, and needs.

You are able to go into the spreadsheet and see what happens when you only trade for 2 hours in the evening.

Step #3: Forward test the strategy on demo.

Trade a demo account with your criteria for 4 months. Get to a place where you are making 3% per month - it’s ok to make less than that. Do not attempt to make more than 3%. It’s not necessary or realistic at this point. Remember, follow the process.

If you don’t make a profit, then review your trades, get feedback from an expert, and go back to step #2.

Step #4: Forward-test the strategy on a live account.

Try and replicate what you did on demo. Make just 2-3% per month for four straight months. The aim is to trade consistently.

You are not trying to make massive amounts of money here. You aren’t going to live off your trading income just yet. Relax and make just a small, consistent gain every month. You are still studying and practicing.

The “making money” portion comes later.

Step #5: Pass a funded challenge and get $40,000.

There are prop firms out there that will give you money to trade with. You want to leverage that to accelerate your progress.

If you are making 2-3% per month, it’ll take you 4 months to pass this challenge and get $40,000. Do not rush it. You are still in the ‘preparation phase’, not the money-making phase.

Step #6: Build that account up to $320,000

If you keep making 2-3%, the funding company will double your capital every four months.

You also get to keep 80% of the profits you make and pocket it.

For example, at $40,000, you will be taking home about $800 per month.

Four months later, you will take home $1,600 per month.

Four months after that, you will be getting $3,200 per month.

Then $6,400. Then $12,800. Then, $25,600. The numbers escalate quickly.

Let the funding company double your account every 4 months. Sit back and be patient.

Step #7: Take the money and put it in an account you own.

The funded account you are trading is not yours. It belongs to the prop firm. You want a large 6-figure account with money that’s 100% yours.

So, take all the profits from the funded account and place it in a trading account you own. Trade this account and keep making 2-3% per month.

This account will grow rapidly. The profits from the prop firm will make sure of that.

Step #8: Live off your trading income.

After a while, you will have two accounts. One is the prop firm, and one is your own.

The prop firm account could pay you $60,000-$120,000 per month. Keep adding that money to your own personal account and then extract a high salary out of your own account. Choose something that’s steady.

Your account will be so large that you can pay yourself even during losing streaks.

This process dominates all the biases out there. You will encounter them one by one and conquer them one by one.

Learn a Profitable Trading Strategy with Structured Education

Let’s start with step #1. Learn a profitable trading strategy with structured education.

The best place for that is The Quick Win Program.

Go here to get started. The first 7 days of the program are just $10.

The idea behind the program is simple.

Learn up to 5 Quick Win strategies and then spend the next 28 days perfecting them with 6-figure traders by your side.

Here’s what you get inside:

#1. Quick Win Step-By-Step Video Lessons with visual illustrations you can watch on-demand - fit it in with your schedule. The strategies are designed for quick wins, meaning they don't take long for the price to go to your target. This allows for faster turnover.

The courses you get access to:

Simon Pullen’s W & M Tops Strategy - Trade these simple reversal patterns on the 1hr chart. They have a very high win rate and reach their targets quickly.

Alex Morris’ Supply & Demand Strategy - Use Alex’s pink and green zone to get high risk:reward trades.

Deni Dantev’s Bollinger Band Strategy - Find big moves on the 4h chart and trade the pullbacks on the 1hr.

Deni Dantev’s Fibonacci Strategy - Trade Fibonacci reversals on any timeframe. This is one of Deni’s favorites when passing Funded Challenges.

Sid Naimain’s Overbought & Oversold Stocks Strategy - Use RSI and MACD to make all your decisions for you with this high win rate method.

#2. 8 Live Trading Sessions per week where you can watch the 6-figure traders use these strategies in action, get any questions answered, and copy their trade ideas. Fully recorded.

Each trader goes live twice per week, and we’re going to throw in a bonus Support Session by Johnathan where he’ll go through the markets with you.

#3. Get all your questions answered even if you can't attend the live sessions by submitting them beforehand. Watch the recordings at 2x speed so you can learn twice as fast.

#4. Quick Win Practice Projects to get you using the strategies without risking your own money. It’ll help you to learn the individual components of each strategy before tackling it as a whole. It is the backbone of structured education.

#5. Quick Win Checklists you can keep open while you trade to help avoid mistakes. You will find these inside of your practice projects. It helps to simplify your trading so you can reduce overwhelm.

#6. Exclusive access to The Trading Academy community, where you can interact with other successful traders. Make friends, learn from each other, and enjoy yourself.

To join for the first week is just $10. You get 7 days to check it out, and then it’s $390 for the remaining weeks.